As many in the miles and points world knows, credit card bonuses are the best way to earn more miles and free travel. Of course, applying for credit cards does come with some risk, and does affect your credit score. Checking your credit score, and checking it often is the best way to know what financial position you are in, and how applying for credit cards affects you.

There are several paid services out there that will check your scores for a fee, but also several that will check them for free.

Starting out at my first Frequent Traveler University, Credit Sesame was the first free service recommended to me, and I find it works well for finding a score. Do note that Credit Sesame looks at your Experian score, and there are three credit agencies that report scores – Experian, TransUnion and Equifax. Credit Sesame is great in that it does not require you to enter a credit card to find out your score.

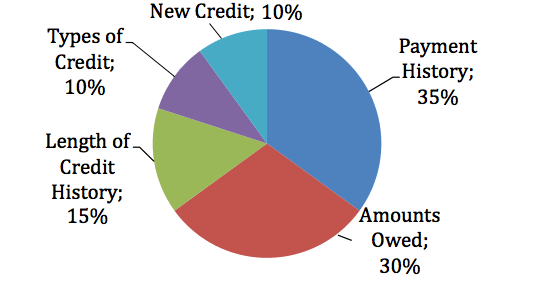

As a review, there are 5 major parts to a credit score:

Interestingly, new credit only counts for 10% of your total score. While this is the smallest make-up of the overall score, one should still be judicious in applying for new cards. The most important factor in any credit score is paying your full balance on-time, every time. If you’re ever paying interest on your credit card, earning miles and points is a loss.

You can check your credit score for FREE here.

Jamie Larounis is an avid traveler, blogger and miles/points educator. Traveling well over 100,000 miles a year and staying in hotels for over 100 nights, he leverages miles, points and other deals to fly in first class cabins, and stay in 5-star hotels. The Forward Cabin shares his experiences, musings, reviews, tips, tricks, resources and industry news with you, the fellow traveler.

Jamie Larounis is an avid traveler, blogger and miles/points educator. Traveling well over 100,000 miles a year and staying in hotels for over 100 nights, he leverages miles, points and other deals to fly in first class cabins, and stay in 5-star hotels. The Forward Cabin shares his experiences, musings, reviews, tips, tricks, resources and industry news with you, the fellow traveler.

Leave a Reply