One of the secrets to getting reduced or nearly free travel lies with the use of miles and points, the currency of loyalty programs, airlines and hotels. More commonly known as “frequent flyer miles,” or, in the case of hotels as “points,” there’s a variety of uses that you can take advantage of. Travel is not always free. However, using airline miles, hotel points and credit card rewards can greatly reduce the cost of travel.

What can Miles and Points Save Me?

A ton. No, really.

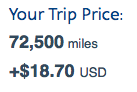

Let’t take a look at a flight from Los Angeles to Melbourne Australia in Qantas’ First Class onboard their A380.

What do you think that flight would cost in dollars? $12,976.

What do you think that flight would cost in miles?

That’s only 72,500 American Airlines AAdvantage miles and close to $20 for the one-way journey that ordinarily would cost nearly $13,000. That’s astonishing, and yet people are redeeming miles like this every day. You can too.

Miles and Points Currencies

There are three major miles and points currencies:

- Airline Miles / Hotel Points

- Fixed-Value Points

- Flexible / Transferable Points

Airline Miles and Hotel Points

This is the simplest type of currency to understand, and is what it sounds like. Often times, you’ll hear this referred to as “butt in seat” miles, meaning you only earn the miles or points when you actually fly, or actually stay in the hotel. With many co-branded credit cards, however, you can now earn airline miles and hotel points directly with the airline/hotel by only spending on their credit card. Typically, when you fly on a flight with a specific airline, you earn “x” amount of that airline’s miles, which you can then spend on reward tickets when you have accrued enough miles. Similarly, with hotels, when you have stayed “x” amount of times or nights, you’ll earn enough of that hotel brand’s points to earn free nights.

Fixed-Value Points

With these programs you’ll earn points that you can then redeem for statement credits, typically at a rate of 1-2 cents per point. You’ll accumulate these points using a credit card, and then redeem those points against purchases you’ve already made. While these fixed-value currencies are great for using on cheap tickets, small expenditures, or miscellaneous fees, it’s not good for using on luxury hotels, premium class airfares, and other luxury travel benefits, since you’ll use more points than what it would have been worth to just outright redeem them for a free night or flight. Essentially, the bank purchases your ticket or fee for you, so there’s no blackout dates as long as there is a seat available (though keep in mind, you’d be paying the current rate of the ticket). Fixed value points also come in the form of cutback, as is common with several credit cards. In general, it’s better to collect actual airline miles or hotel points rather than wait for enough cash back or fixed-value points to accumulate in order to redeem.

Flexible and Transferrable Points

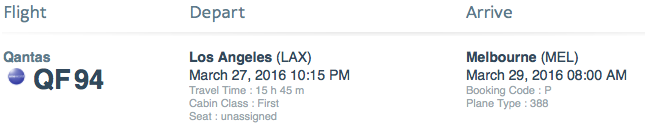

There are three major ways to earn flexible or transferrable points: through American Express Membership Rewards, Chase Ultimate Rewards, or through the Starwood Preferred Guest Program. With the points you accrue through these programs, you have an array of airlines and hotel brands you can transfer your points into, when you want to complete a redemption. Once the points transfer, they’re non-refundable, so you’ll want to make sure you have a use for them before exchanging. Typically, flexible points can be transferred at 1:1 ratio, meaning you’ll take one rewards point and transfer it to one airline mile. Keep in mind that several banks offer transfer bonuses, too.

American Express Membership Rewards Transfer Partners:

Chase Ultimate Rewards Transfer Partners

Starwood Preferred Guest Transfer Partners

Earning Miles and Points

There are several ways to earn miles and points, however in most cases, it comes down to two methods: traveling itself, and use of credit cards. When you travel, you earn miles and based upon how much you fly, spend, stay, etc. Sometimes you can earn a bonus depending on promotions. The more you travel with a particular brand, the more you’ll earn with them,. Alternatively, you can purchase things using a credit card, which will allow you to earn not only specific miles for a frequent flyer program, but also transferable points that can be used to move into a program of your choice. Typically credit cards have various earning bonuses, so you want to pay attention to which credit card you use for which purchases that way you can maximize your earning potential. Some credit cars offer double points on gas, or triple points on groceries, for example. In addition, consider applying for credit cards with high sign up bonuses that will allow you to accumulate large sums of miles in a quick amount of time. Also consider shopping portals where you earn miles based upon what you purchase online. If you have a choice between purchasing an item in a retail store or online, purchase it online via a shopping portal where you can earn bonus miles that otherwise wouldn’t be able to be earned in-store.

Using Your Miles and Points

Once you’ve collected enough of your preferred currency, you now need to figure out how to use your miles.

With airline miles and hotel points, you’re looking for specific availability through the brand. Airlines release various kinds of award space that may or may not be available for your preferred dates. In order to search for this “space,” contact the airline direct or visit their website. Just because you see a seat available on a particular flight does not mean you can use miles for it. Airlines have various policies according to how they release this inventory, and if you’re looking for the cheapest use of miles, sometimes you’ll need to be flexible in your plans. Some airline programs offer last seat availability where they will offer you the last seat on the plane, but for a higher mileage price. Using hotel points is much easier, since, in many cases, most major chains offer the use of points so long as a room is available at the property. You can also use your hotel points for upgrades, club access and other add-ons.

With fixed value points, you’re redeeming the cash back or points you’ve earned to cover a statement charge. Some credit cards offer a 2x the points on all purchases, which you can then redeem against a specific travel-coded purchases. Other credit cards offer cash back on all purchases, allowing you to redeem that cash-back for whatever you wish. To use these points, you’ll contact the credit card company directly or sign into your online account.

With a transferrable point currency, you’ll end up moving these points into one of the associated frequent traveler programs. Some of these transfers are instant while others take several days, but in either case, you’re transferring them with a desired purpose in mind. If you wish to transfer your points to British Airways, for example, ensure the flight you wish to redeem for still has award availability at the time of transfer, so you can then book through British Airways once the points have fully been deposited in that account.

Want to figure out how many miles it will cost to get to your destination?

Want to know where you should search for airline award space to help you book your trip?

Tips and Tricks

For someone collecting miles for the first time, to a seasoned traveler, both earning and burning points currencies can be daunting. In general, follow these tips to ensure a smooth experience.

- Ensure you have credit cards that meet the categories you usually spend on. For example, if you spend money on gas, groceries and office supply stores, make sure you have credit cards that earn more than one mile/point per dollar on those expenditures.

- Don’t save your miles. Once you collect them, and you have enough to book an award, do it. Miles and points don’t earn interest, and it doesn’t benefit you keeping them in an account where they could expire, or the program’s award charts could change.

- Don’t collect too few miles in too many programs. Having only a few thousand points or miles spread across several programs doesn’t allow you to spend them. Consider collecting only in a select few programs, or in a transferable currency that you can be flexible with.

Jamie Larounis is an avid traveler, blogger and miles/points educator. Traveling well over 100,000 miles a year and staying in hotels for over 100 nights, he leverages miles, points and other deals to fly in first class cabins, and stay in 5-star hotels. The Forward Cabin shares his experiences, musings, reviews, tips, tricks, resources and industry news with you, the fellow traveler.

Jamie Larounis is an avid traveler, blogger and miles/points educator. Traveling well over 100,000 miles a year and staying in hotels for over 100 nights, he leverages miles, points and other deals to fly in first class cabins, and stay in 5-star hotels. The Forward Cabin shares his experiences, musings, reviews, tips, tricks, resources and industry news with you, the fellow traveler.

Leave a Reply